It could be called the one that got away.

Twelve years ago, officials at Eli Lilly and Co. pulled the plug on a much-anticipated experimental medicine for diabetes after it failed to prove effective at lowering patients’ blood sugar during a late-stage clinical trial.

It was a stinging disappointment. For more than a year, officials at the Indianapolis-based drugmaker had pinned their hopes on the drug, called teplizumab, to help turn the company around after a series of pipeline disappointments and a looming patent cliff on older medicines.

John Lechleiter, then-CEO, cited teplizumab as one of the three most promising experimental drugs in the company’s pipeline. Lilly had acquired the exclusive rights to the drug in 2007 from MacroGenics, a small biotech firm based in suburban Washington, D.C.

But Lilly’s high hopes came crashing down in October 2010 when an independent monitoring committee concluded that the drug failed to hit its goal, which was a composite of total daily insulin usage and blood-sugar levels in Type 1 diabetes patients. Lilly announced it was suspending the study while it determined what to do next.

“The failure to meet the primary endpoint is obviously disappointing for the millions of people who live with and treat type 1 diabetes,” Lilly said at the time. Shares in the drugmaker fell 5% on the news, and headlines underscored the defeat.

“More diabetes drug woes for Lilly as teplizumab fails,” said Pharma Times, an industry newsletter.

“In fresh setback, Lilly scuttles teplizumab program,” said Fierce Pharma, another industry newsletter.

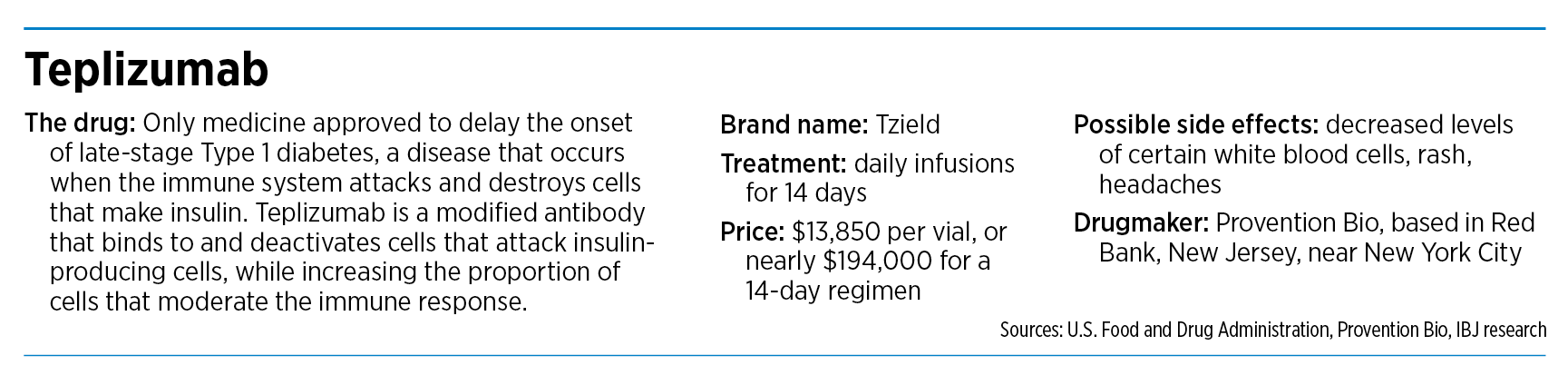

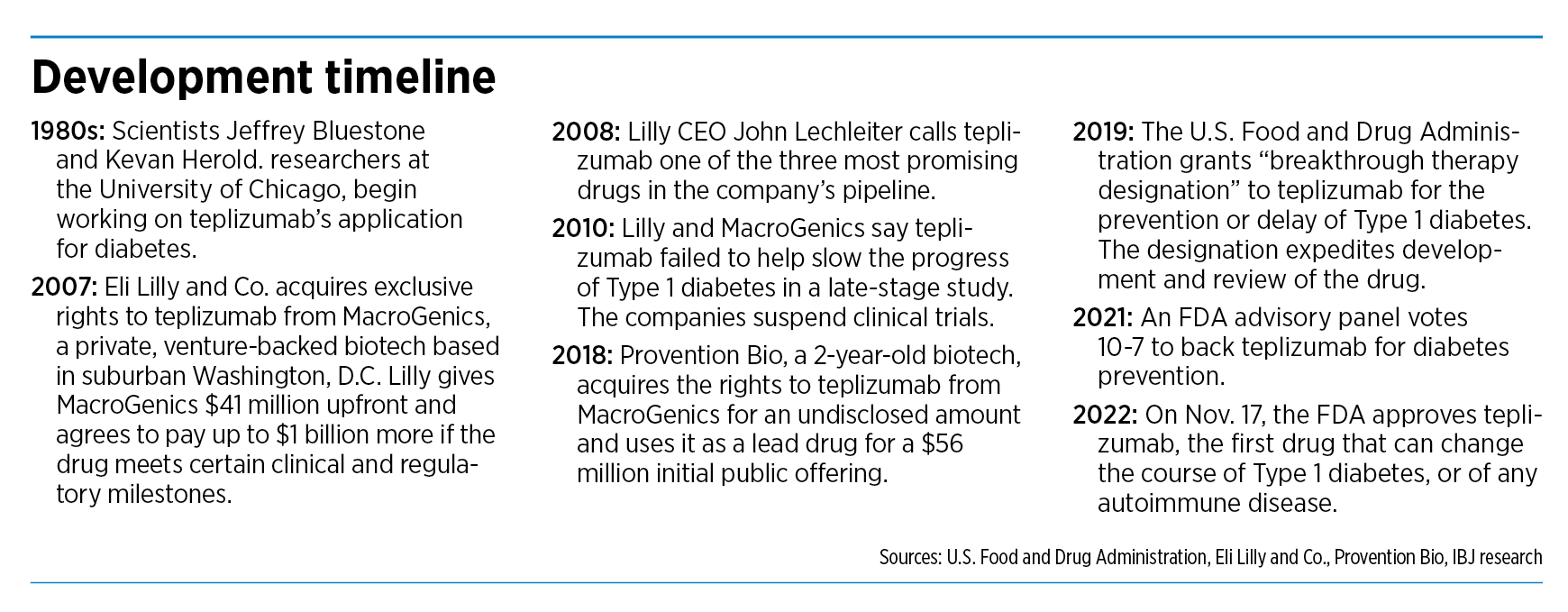

But now, in an amazing resurrection, teplizumab is one of the hottest new drugs on the market. Last month, the U.S. Food and Drug Administration approved teplizumab, making it the first drug to delay the onset of late-stage type 1 diabetes in adults and child 8 years and older.

Some analysts say the drug could be a game-changing blockbuster, meaning it could ring up annual sales of $1 billion or more at its peak.

But this time, Lilly is on the sidelines. The company, which made a name for itself in diabetes in 1923 when it became the first drugmaker to commercialize insulin, gave up the rights to teplizumab shortly after it abandoned development.

A new home

Now, another company could be reaping the riches. In 2018, Provention Bio, a small biotech based in Red Bank, New Jersey, acquired the rights to teplizumab from MacroGenics for an undisclosed sum. And after a bumpy, four-year ride, filled with several temporary setbacks, the company is preparing to launch the drug under the brand name Tzield.

The drug does not cure or prevent diabetes, but studies show it can delay the onset of the most severe form of the disease by an average of two years.

“The drug’s potential to delay clinical diagnosis of type 1 diabetes may provide patients with months to years without the burdens of disease,” Dr. John Sharretts, the FDA’s director of diabetes, lipid disorders and obesity said in written remarks on Nov. 17.

For Lilly, the decision to give up on teplizumab to concentrate on other pipeline projects might come with a tinge of regret in light of the latest news. But the drugmaker is not publicly second-guessing things.

In a one-sentence statement to IBJ, Lilly pointed out that it continues to work on new diabetes treatments. It stayed away from commenting directly on teplizumab.

“Long-term prevention and/or treatment of type 1 diabetes continues to be an important priority for Lilly and we welcome all advancements in diabetes care that may improve outcomes for patients,” the company said.

For Lilly, of course, the picture is immensely brighter today than a decade ago. The company has launched new drugs for cancer, arthritis, pain and other maladies. Investors hope the company will launch new medicines in the next year or so for Alzheimer’s disease and obesity, two huge markets that could reap untold billions of dollars in sales.

Lilly’s stock has climbed sharply in recent years and is now trading in the $360 range, about 10 times higher than when it dropped teplizumab.

Not a strange route

And to be sure, the football bounce of teplizumab is not an isolated case. Around the world, pharmaceutical companies shelve or abandon experimental drugs every year for various reasons, including clinical results that don’t meet expectations, a change in company strategy or new regulations that shift the industry landscape.

Nine out of 10 experimental drugs that enter clinical trials fail to make it all the way to product launch, according to the American Association for the Advancement of Science. Even half of the experimental drugs that advance to the final stage of clinical testing will fail.

And in some of those cases, a drug will lie neglected for years before another company acquires it and tries its own set of tests.

“A drug being discovered by one company and commercialized by another happens frequently,” said Brian Stemme, CEO of Hoosier Cancer Research Network, a not-for-profit organization that helps oncologists design and execute clinical trials. “Drug discovery is a winding path, and there are so many variables that can impact this process that it’s almost inevitable that things will change significantly.”

Pharmaceutical companies often must make tough decisions about which drugs to advance in the clinic and which to shelve. Those choices often come down to a close study of the market, the competition and regulators as well as where the investment is most likely to pay off.

George Telthorst, director of the Center for the Business of Life Sciences at Indiana University, said drug companies have to consider constraints on their budgets and how many patients are most likely to be helped by a new product.

“It is not uncommon for pharmaceutical firms to trim their development portfolios and then have another firm pick up something,” he said.

Mary Mader, vice president of molecular innovation at the Indiana Biosciences Research Institute, an organization that helps academic and industry researchers develop inventions, said large drug companies often have a change in strategic direction that decreases their interest in an experimental drug.

“It’s not unusual for a pharmaceutical company to elect to discontinue the development of an asset for several reasons and then to sell it to another interested party that continues to do clinical development on it,” she said.

Perhaps no drug in recent years took a longer, more winding path than Keytruda, the world’s top-selling cancer medicine, made by drugmaker Merck & Co., with sales last year of $17.2 billion.

The drug was invented in 2003 by a team of Dutch scientists at Organon & Co. in the Netherlands, under the generic name pembrolizumab. Another drugmaker, Schering-Plough, acquired Organon in 2007, and Merck acquired Schering-Plough two years later.

In early 2010, Merck terminated development of pembrolizumab and began preparing to out-license it. But the company changed its mind soon afterward when scientists from rival Bristol Myers Squibb published a paper showing positive results from immunotherapy drugs in treating various forms of cancer.

Merck had little expertise in oncology or immunology, Forbes magazine wrote in 2017. But it quickly shifted gears when it recognized the opportunity.

“From what was literally a standing stop, Merck urgently reactivated [its investigational new drug application] in mid-2010, targeting a filing by the end of the year and achieving it in December,” Forbes wrote.

In 2015, the FDA approved the drug treatment of metastatic non-small cell lung cancer, the first of many approvals for what would become one of the most successful drugs in decades.

“So if one of the biggest drugs in the world was not actively pursued for years, you can tell that it’s a business with a high level of uncertainty and differences in the value of perception,” Stemme told IBJ.

Long and winding road

In the case of teplizumab, the road has been just as long and winding. Two researchers at the University of Chicago, Jeffrey Bluestone and Kevan Herold, developed the drug in the 1980s in collaboration with Ortho Pharmaceuticals of New Jersey, which developed the initial antibody.

The drug was later picked up by MacroGenics, a small, private equity-backed biotech that focuses on autoimmune disorders, cancer and infectious disease.

In 2007, MacroGenics announced a licensing and collaboration agreement with Lilly, which was looking for promising new drugs to help it navigate one of the roughest patches in its history. At the time, Lilly was about to lose patent protection on five large drugs that represented about 50% of its revenue.

Picking up experimental drugs to treat diabetes seemed like a natural move. Lilly had been a leader in diabetes for more than eight decades and had developed a wide array of insulins and other medicines to treat patients.

Moreover, the diabetes epidemic was showing no sign of slowing, with hundreds of thousands of patients needing treatments. Each year, roughly 30,000 new people are diagnosed with type 1 diabetes in the United States. It’s a lifelong disease that requires diet management and insulin therapy.

“We will continue to seek out innovative molecules to add to our diabetes portfolio in order to best respond to the growing health crisis posed by diabetes worldwide,” Dr. David Moller, Lilly vice president of endocrine and cardiovascular research said at the time in written remarks.

Under the deal, Lilly gave MacroGenics an upfront payment of $41 million, along with $3 million in other committed funds.

The deal seemed bright to MacroGenics too. The company stood to pick up hundreds of millions of dollars more if the drug hit certain clinical and commercial milestones.

“We are delighted to enter into this deal with Lilly, an established leader in diabetes care,” Dr. Scott Koenig, CEO of MacroGenics said.

Yet, just three years later, the two companies would stun patients, caregivers and investors when their late-stage clinical trial failed to hit its endpoint after spending millions of dollars to enroll and dose patients. Lilly would give up all rights to the drug.

It was up to the original researchers to find a new company to continue work on the drug, even as they left the University of Chicago and went their separate ways—Herold to Yale and Bluestone to the University of California in San Francisco.

The two spent years looking for one pharmaceutical partner after another who could help. The researchers spent 20 years “trying to keep the drug alive,” Herold told The New York Times last month.

The next big break came in 2018, when Provention Bio acquired the rights to teplizumab from MacroGenics.

“Eight years after Eli Lilly dumped it, an upstart biotech has nabbed teplizumab,” said a headline in Endpoints News, an industry newsletter.

And a year later, the companies released trial data that said teplizumab almost doubled the median time of diagnosis for late-stage type 1 diabetes compared to a placebo (48.4 months versus 24.4 months).

Last year, an FDA advisory committee voted narrowly to recommend that teplizumab be approved. The committee noted that the study didn’t meet its enrollment goal and raised some concerns about the size of the study and data on effectiveness. Nevertheless, last month, the FDA approved the drug.

“Provention claims success where Lilly failed,” said a headline at Evaluate.com, a data company specializing in the pharmaceutical industry.

But can Provention Bio, a tiny biotech founded in 2016 and with still fewer than 100 employees, commercialize such a groundbreaking drug?

Two months ago, it gave an answer by announcing it had signed a marketing agreement with pharmaceutical giant Sanofi U.S. to help launch the drug.

Under the terms of the agreement, Sanofi will commit diabetes field specialists, account directors and medical liaisons to help promote the drug to doctors and other health care providers. Provention Bio will retain all rights to the drug.

And in another local twist, the Indiana University School of Medicine let out a cheer last month after the FDA approval. Researchers at the medical school had helped conduct clinical trials and led data collection and analysis of the drug.

“Since the early ’90s, people have been trying to delay onset of type 1 diabetes. This is the first successful drug to do that,” said Dr. Emily K. Sims, associate professor of pediatrics and a physician scientist with the Center for Diabetes and Metabolic Diseases and the Herman B. Wells Center for Pediatric Research at IU School of Medicine.

And in a bit of understatement, in commenting on a topsy-turvy journey of more than three decades, she added: “People in the field are super excited.”•

if ( typeof LD == “object” ) { LD.initPage(); }

Please enable JavaScript to view this content.

Editor’s note: You can comment on IBJ stories by signing in to your IBJ account. If you have not registered, please sign up for a free account now. Please note our updated comment policy that will govern how comments are moderated.

You must be logged in to post a comment.

Join the thousands of business and community leaders and Indiana residents that choose IBJ as their primary local news source.

More events

More nominations